The shadow behind the climate crisis: the biodiversity crisis. How can we drive investment into nature recovery?

Why we invested in Pivotal

💡 Want to start by going deeper into the biodiversity research? Check out our public Notion where we share some of our research into the space here.

Nature powers our economy

Businesses around the world rely on our diverse plant and animal species to create products and services. Half of the world’s GDP is dependent on nature. In fact, there is no major industry in the world - from mining to insurance to fishing - that is not significantly impacted by biodiversity loss already, or will be over the next 10 years, and the World Economic Forum ranks biodiversity loss in its top 3 global risks over the coming decade.

Why? Because land use change, pollution and overexploitation has destroyed much of the natural world. We have now severely altered around three quarters of land and two thirds of marine ecosystems. One million plant and animal species are now under threat of extinction, and 68% of all monitored wildlife populations have been lost in just 50 years (1970-2016). Insect populations are under danger of collapse - which would devastate our global food production, as 3 out of 4 crops depend on insects for pollination. These losses are all compounded by climate change: both a cause and an effect of ecological decline. Biodiversity provides almost every ecosystem service we rely on - from climate regulation to water purification and soil fertility, but to date we have ignored the threats to biodiversity and nature.

There is some good news. Biodiversity is finally getting the international attention it deserves. In 2021 the UN launched the ‘Decade on Ecosystem Restoration’ - a rallying call for the protection and revival of ecosystems. 98 financial institutions signed the Finance for Biodiversity Pledge in 2022, representing 19 countries and almost 14 trillion Euro in assets.

The Nature Positive movement is gaining momentum too. More and more businesses - like Nestle, PepsiCo and Unilever - are making commitments to manage their impact on nature, recognising that ecological decline is a systemic risk. The Nature Positive movement is inspiring businesses to commit to become overall nature positive, across their value chains, compensating for those impacts they cannot avoid.

Learning from the carbon markets

There is increasing recognition of the value of biodiversity - and a renewed appetite to invest in restoring and preserving nature - but the next question is where exactly to deploy this capital.

After all, how do you actually measure and assess changes in biodiversity? How do you make sure that actions to preserve biodiversity result in nature positive outcomes, rather than just well-intentioned commitments or actions that sound great but don’t deliver what you’d hoped? And if you’re a corporation, how do you prove - to employees and the public - that your funding of nature has delivered results?

Proof and trust are important. With the carbon market, evidence came too late. Companies discovered that they had spent millions on projects which sequestered much less carbon than claimed, or where trees were planted as monocultures, which support very little biodiversity and can have overall negative outcomes for the planet.

Valuing only the carbon sequestration potential of natural systems can create poor incentives because what is good for carbon is not always good for biodiversity, and we cannot solve the climate crisis if we destroy nature while trying. Increasing biodiversity, on the other hand, almost always has a carbon co-benefit. However, unlocking the potential value of nature has been historically challenging.

Measuring the uplifts in nature

One of the major barriers is that to date it’s been expensive to measure changes in biodiversity and extremely complex to analyse and value those changes once you do measure them. Traditional biodiversity surveys require teams of expert ecologists to collect data over months, returning multiple times per year and then analysing reams of data - all while using expensive, time consuming methods like manually identifying and counting species in the field.

Biodiversity is complicated and highly local - each location has its own unique combination of species. You can’t exchange one species for another, but nor is it realistic to count every single frog or lizard. And there is no ton of biodiversity as there is for carbon. So it’s challenging to turn biodiversity data into measures that are intuitive and yet real and detailed enough to enable small changes to be tracked over time. The expense and complexity of collecting and analysing biodiversity data mean that we don’t (yet) have good, scalable data solutions for nature. For this reason, most investments in nature are for actions, not outcomes. This is what Pivotal is trying to change.

Introducing Pivotal

We invested in Pivotal in 2021- co-founded by Zoe Balmforth and Cameron Frayling. Pivotal is creating solutions which enable customers, whether companies or individuals, to invest in measured outcomes for nature. To do this, they have started by enabling affordable measurement of biodiversity at scale. Zoe has over 20 years of experience in this sector, including field-based ecology and nature conservation in South Africa, Liberia, Tanzania, and Brazil; public policy as a British Diplomat, and academic research and corporate strategy. Cameron is an experienced founder of life science companies and inventor of several novel molecular biology techniques in the field of genetics and genomics.

Pivotal’s plan is to create ‘Nature Uplifts’: measurement-backed biodiversity credits based on real, measured biodiversity gains. These are outcome-based credits that allow businesses to invest in nature by funding landowners to regenerate biodiversity on their land. Credits act as a financial incentive for farmers, foresters and land managers to work in ways that benefit nature - through methods like rewilding, agroforestry and planting biodiverse forests.

Landowners are often willing to make the change. Sometimes they have already begun to experience the impacts of biodiversity decline through things like increasing need for artificial fertiliser or reducing yields. Sometimes they would love to see more biodiversity return to their land but cannot afford to make that switch without a change in land use incentives.

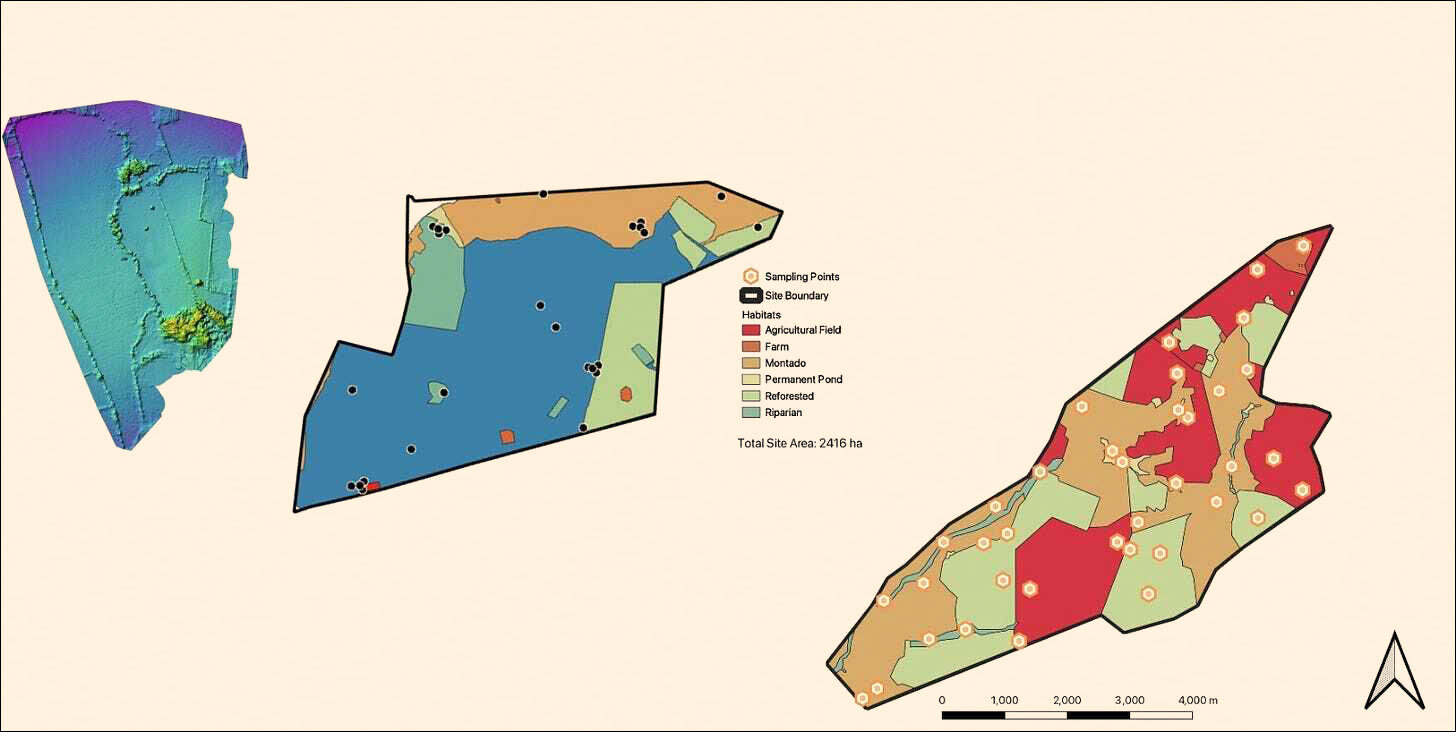

To ensure that Nature Uplifts can harness financing for nature and channel it towards positive outcomes, data and evidence are key. Pivotal is therefore building the monitoring and analysis techniques that can scale for the challenge: through drones, acoustic and image sensors combined with data analytics underpinned by machine learning. Pivotal is acting as the data layer to monitor plant and animal life on the ground and provide the evidence for ‘before and after’ nature gains in switching to new regenerative practices. By using technology they plan to reduce the number of people (and therefore cost) needed to collect data, and by deploying machine learning they can slash the time required for data handling and analysis.

What’s next?

When we think of the climate crisis, it is easy to think in terms of CO2, methane and other atmospheric gases. We rarely think about the shadow behind the crisis - the biodiversity and nature crisis and the other planetary boundaries we are crossing due to human intervention.

Right now we have a short window to preserve the natural ecosystems that prop up our entire economy and way of life. Until recently, biodiversity monitoring and analysis have been nice-to-haves. Quickly they are becoming must-haves. Economic incentives have historically not been aligned with preserving or cultivating biodiversity, but land owners have the will to switch to better practices, and the first step is to drive financing to these land owners.

To make this a reality, the second step would be to provide cost-effective measurement tools so we can successfully map these uplifts and turn them into a trusted commodity. The emerging biodiversity credit market requires comprehensive and accurate measurement to underpin it - and Pivotal is set on building cheaper ways to capture biodiversity data and analyse it quickly. It is hard to imagine living in a world without nature, but it is impossible to imagine living in a world where natural resources don’t support our life on earth - through reliable food supplies, fresh water and medicine. We’re excited to support Pivotal in their journey ahead.

Read more about Pivotal here.

💡 Interested to go deeper? To read more biodiversity research check out our public Notion where we share some of our research into the space here.